Important: Parking as a Taxable Benefit

Posted on | Updated

Effective September 1, 2021.

Subject: Important: Parking as a Taxable Benefit

Effective September 1, 2021 employees requesting an employee parking pass will be assessed a taxable benefit for each month they are in possession of the pass.

The Canada Revenue Agency (CRA) assesses a taxable benefit for parking provided to employees at less than fair market value. Fair market value is determined to be the cost the university incurs to obtain parking (including applicable taxes).

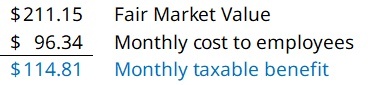

The taxable benefit is the fair market value less the amount paid by the employee through payroll deduction, calculated as follows:

For each month a parking pass is in an employee’s possession, a taxable benefit of $114.81 will be added to their income as earnings subject to Canada Pension Plan contributions and Income Tax deduction.

This treatment is the same as other employer-paid taxable benefits.

You can view more information by visiting the CRA online: CRA - Parking.

Additional questions can be directed to:

- Salaried Payroll group: Email to paysalary@ecuad.ca

- Temporary & Hourly Payroll group: Email to payhourly@ecuad.ca

Resources:

- Taxable Benefit – Parking FAQ

- Taxable Benefit Parking Exemption Form